LOW INTEREST RATES HAVE ENTICED MANY HOMEOWNERS TO REFINANCE FOR SMALLER MONTHLY PAYMENTS

Refinancing Your Mortgage Could Be A Game Changer

Schedule Your Mortage Review

You have checkups every year for your health, your pets and your vehicles – now we recommend one for your finances and homes, too!

What’s a Mortgage Review?

I will work with you and review your monthly payment in detail, including your credit, mortgage insurance (if applicable) and income. Next, we’ll discuss any available options. During your mortgage review, you might discover opportunities that could give you greater financial flexibility and help you save!

Mortgage Review for Rutland

Let’s get started by answering some basic questions.

It looks like 2021 isn’t the only thing that’s off-and-running. The housing market still thrives with low interest rates, stable home prices, and competitively low inventory.

Add it all together, and you’re looking at a year of opportunity ahead.

Whether you’re looking to buy a home, refinance the home you currently own, or you’re looking to increase your home’s value while staying put, I’ve got something for everyone.

So, let’s pause the pandemic talk and discuss ways that you can put 2021’s housing market to work for you.

Refinancing has saved my clients tens-of-thousands of dollars on their loans.

Here are some of the ways my clients have benefited from refinancing:

They’ve lowered their monthly payments, giving them more disposable income.

They’ve reduced the term of their loan, for example, going from a 30-year mortgage down to a 15-year mortgage.

They’ve cashed in on their home equity to assist with college tuition, home renovations, or just to have cash-on-hand for an emergency.

It’s a Seller’s world and we’re all just living in it.

Stay informed. Stay financially healthy.

If you’re on the fence about selling your house, now is a great time to take advantage of sky-high demand, low supply, and fierce buyer competition. If you’re in a position to move, your house may stand out from the crowd.

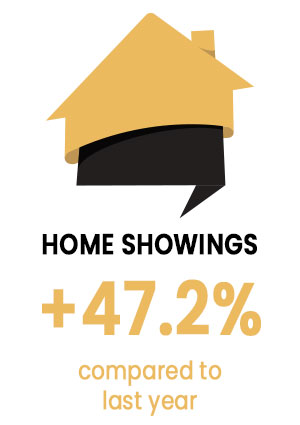

Take a look at the infographic below and check out the stats for yourself:

Not bad, right? A nearly 50% increase in showings over one year means buyers are hungry and are ready to pay top price for your home.

If you’re ready to list your home, you’ll need a new one. That’s why I suggest getting in touch before you plan to sell. This way, I can help you prepare for any mortgage needs your next property may require.

I might sound like a broken record… But when something’s true, you’ve got to share it.

As a homeowner, you have plenty of options right now. You could take advantage of low rates by refinancing, or you could also sell for a favorable price in a high-demand housing market. Even better is that you’ll likely have buyers competing for your home.

Brian Hunton

Rutland, MA Resident

MBA Mortage, Team Leader

NMLS/MLO #30967 | MA #MB2880

508-395-5739 (cell)

978-575-3053 (office)

888-225-4341 (fax)

Brian@TeamHuntonMortgage.com

Contact Brian

Our News

How Payment History Impacts Your Credit Score: 4 Easy Ways to Improve It by 35%

📊 Why Payment History Is So Important Your credit score tells lenders how trustworthy you are with money. Out of all the things that impact your score, payment history is the biggest piece — a full 35%! That means even just one late payment can lower your score, affect your loan approval, or change the interest rate you’re offered. Late...

Four Steps to Create Financial Independence Through Mortgage Planning

💡 What Is Mortgage Planning? Mortgage planning is more than just getting a home loan. It's about making smart choices with your mortgage, debt, and cash flow that help you reach your financial goals. As a Certified Mortgage Planning Specialist, my job is to guide you through these choices with clear steps and long-term thinking. Whether...

🏦 HOW PAYMENT HISTORY IMPACTS YOUR CREDIT

These 4 Tips Can Improve Your Score by Up to 35% 📊 Why Payment History Matters Your payment history is the #1 factor in your credit score, making up 35% of the total. Lenders want to see that you pay on time—every time. When you pay your bills late or miss payments, it sends up a red flag. It can hurt your score and make borrowing more...